Introduction to portfolio optimization¶

Contents

Objective function¶

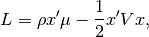

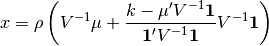

In mean-variance portfolio optimization we maximize, subject to various

constraints on the portfolio weights  , the objective function

, the objective function

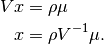

(1)¶

where  (a scalar) is the risk tolerance,

(a scalar) is the risk tolerance,  (a

(a  vector) is the expected return,

vector) is the expected return,  is the (

is the ( )

covariance matrix of asset returns,

)

covariance matrix of asset returns,  (

( ) is a vector

of portfolio weights, and

) is a vector

of portfolio weights, and  is the number of assets.

is the number of assets.

Because we like return (the first term in Eq (1)) but don’t like

variance (second term), we want to find the portfolio  that maximizes

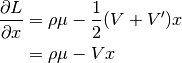

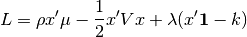

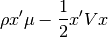

Eq (1). To do so, the derivative of

that maximizes

Eq (1). To do so, the derivative of  is more useful than

is more useful than

itself:

itself:

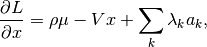

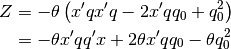

(2)¶

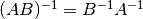

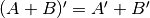

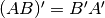

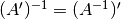

where we have made use of the fact that  and that the covariance matrix

and that the covariance matrix  is symmetric (i.e.

is symmetric (i.e.

).

).

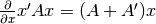

Here’s some more matrix algebra that will come in handy:

Minimum variance¶

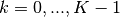

Let’s start by finding the minimum variance portfolio subject to the constraint

that the weights  sum to

sum to  . (If we did not add a sum to

. (If we did not add a sum to

constraint then the minimum variance portfolio would be to have zero

weight in each asset.)

constraint then the minimum variance portfolio would be to have zero

weight in each asset.)

Because the sum to  constraint is a linear equality constraint

(

constraint is a linear equality constraint

( ), we can use the Lagrange multiplier method to add the

constraint to Eq (1):

), we can use the Lagrange multiplier method to add the

constraint to Eq (1):

where  is a

is a  vector of ones.

vector of ones.

Setting  to zero since we have no tolerance for risk, gives:

to zero since we have no tolerance for risk, gives:

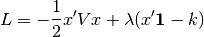

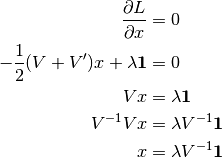

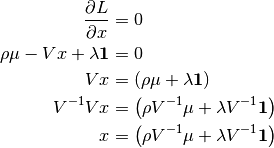

Setting the first derivative of the Langrangian (with respect to a change in the portfolio weights) to zero and solving for the minimum variance portfolio gives

(3)¶

But what is the value of the Langrange multipler  ? From the

sum-to-

? From the

sum-to- constaint,

constaint,  is also given by

is also given by

(4)¶

Substituting Eq (3) into Eq (4) gives

(5)¶

Finally substituting Eq (5) into Eq (3) gives the minimum

variance portfolio that sums to  :

:

Mean–variance¶

Next, let’s find the optimal mean-variance portfolio without a constrait on the sum of the portfolio weights.

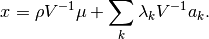

We wish to find the  that maximizes Eq (1). To do so we take

the derivative of

that maximizes Eq (1). To do so we take

the derivative of  (as is already done in Eq (3)) and solve

for

(as is already done in Eq (3)) and solve

for  to get the optimimal portfolio with no constraint on the sum

of the weights:

to get the optimimal portfolio with no constraint on the sum

of the weights:

Let’s now add a sum-to- constraint.

constraint.

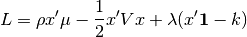

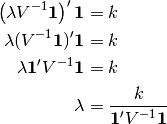

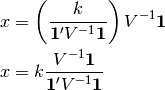

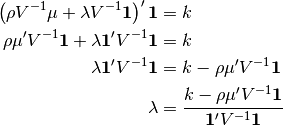

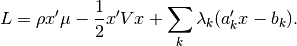

Given that we are optimizing a convex function subject to linear equality

constraints (sum-to- ), the method of Lagrange is guaranteed to

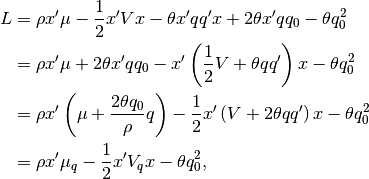

produce an optimal solution. The Lagrangian is

), the method of Lagrange is guaranteed to

produce an optimal solution. The Lagrangian is

Setting the first derivative equal to zero and simplifying gives

(6)¶

Substituting Eq (6) in Eq (4):

(7)¶

Finally substituting Eq (7) into Eq (6) gives

the portfolio that, given the sum-to- constraint, makes the optimal

trade-off between expected return and variance:

constraint, makes the optimal

trade-off between expected return and variance:

General linear-equality constraints¶

In the preceding section we described mean-variance optimization under a linear

equality constraint of  . We can generalize that result

so that it applies to multiple, simultaneous linear equality constraints of the

form

. We can generalize that result

so that it applies to multiple, simultaneous linear equality constraints of the

form  .

.

We want to maximize the utility

subject to the constraints  for constraints

for constraints  ,

,

. The Lagrangian for this problem is

. The Lagrangian for this problem is

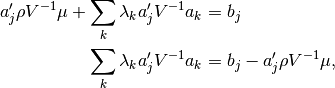

Taking the partial of  with respect to

with respect to  , we find that

, we find that

and setting this to zero yields

Substituting this solution into each constraint yields, for each

,

,

which can be expressed in matrix form as

![\left[a_j' V^{-1} a_k\right] \left(\lambda_k\right)

= \left(b_j - a_j' \rho V^{-1} \mu\right),](_images/math/b870d254fd1dec08b8a8e155bbe9a7f07854e9b2.png)

where square brackets indicate a matrix and parentheses indicate a column

vector, and where  indexes columns and

indexes columns and  indexes rows.

indexes rows.

By solving the matrix equation above, we can find the  and

this in turn allows us to find the optimal

and

this in turn allows us to find the optimal  .

.

Soft constraints¶

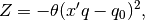

In this section we add soft linear equality constraints. Soft constraints are like equality constraint but instead of insisting on equality at all cost, we allow a deviation from equality. A penalty proportional to the squared deviation from equality is subtracted from the objective function

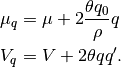

A generic quadratic penality  can be expressed as

can be expressed as

where  is a scalar that tells us the strength of the penality,

is a scalar that tells us the strength of the penality,

is a

is a  vector such as a vector of stock betas, and

vector such as a vector of stock betas, and

is a scalar away from which we penalize values of

is a scalar away from which we penalize values of  .

Simplifying gives

.

Simplifying gives

(8)¶

Adding the quadratic penalty  to the objective function

to the objective function  in

Eq (8) gives

in

Eq (8) gives

where

So adding soft linear equality constraints to an algorithm that finds mean-variance optimal portfolios could not be easier—no modification is necessary. We need only to adjust the expected return and the covariance matrix.

Inverse of covariance matrix¶

The equations above take the inverse of the  covariance

matrix of asset returns, where

covariance

matrix of asset returns, where  is the number of assets.

is the number of assets.

Of the two meva optimizers, aopt and nopt, only aopt takes an explicit inverse. In fact the bottleneck of the analytical optimizer aopt is typically in finding the inverse of the covariance matrix.

Here’s a trick that for 500 assets and 10 risk factors, speeds up aopt by a

factor of 7. (The downside of the trick is that the individual variance,

, can no longer be zero.)

, can no longer be zero.)

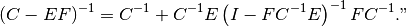

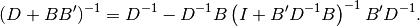

Lemma 0.28 of Edgar Brunner’s lecture notes (October 14, 2002) states: “Let

,

,  ,

,  and assume that the inverses

and assume that the inverses  and

and  exist. Then,

exist. Then,

(9)¶

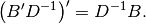

Making the following substitutions

Eq (9) becomes

(10)¶

Note that

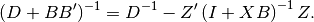

Finally, making the substitution  in Eq (10)

gives

in Eq (10)

gives

(11)¶

Let’s try an example. Create a covariance matrix:

>>> n = 500; k = 10

>>> b = np.random.rand(n,k)

>>> d = np.random.rand(n)

>>> cov = np.dot(b,b.T) + np.diag(d)

Take the inverse the brute-force way:

>>> timeit np.linalg.inv(cov)

10 loops, best of 3: 59.9 ms per loop

And now that fast way:

>>> from meva.opt.util import fast_inverse

>>> timeit fast_inverse(b, d)

100 loops, best of 3: 7.1 ms per loop

Numerical optimization¶

For some problems an analytical solution does not exist.

We’ve seen that linear equality constraints can be easily handled analytically.

But what happens when you want the sum of the shorts to be  and the

sum of the longs to be

and the

sum of the longs to be  ? In that case we do not know ahead of time

which assets will be short and which will be long.

? In that case we do not know ahead of time

which assets will be short and which will be long.

The numerical optimizer in meva is based on an heuristic, gradient method. The heuristic part refers to dealing with the complications of a long-short portfolio with constraints.

See here for background on the gradient method of portfolio optimization.