Covariance matrix estimation¶

Meva provides two methods to estimate the covariance matrix of log asset

returns: one, cov_pca based on pricipal component analysis (PCA) and one,

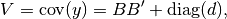

cov_fa based on factor analysis. Both functions return  and

and

such that the covariance matrix

such that the covariance matrix  is given by

is given by

where  is a

is a  matrix mapping

matrix mapping  factors to

factors to

assets,

assets,  is…

is…

cov_pca (PCA-based)¶

The cov_pca function uses principal component analysis to fit a factor-model

decomposition of market variability. This model decomposes the market return

into two parts:

into two parts:

Here,  is a

is a  matrix mapping

matrix mapping  factors to

factors to

assets,

assets,  is a draw from a

is a draw from a  dimensional iid standard

normal distribution, and

dimensional iid standard

normal distribution, and  is a draw from an independent normal

distribution in which the variance of the

is a draw from an independent normal

distribution in which the variance of the  -th component is given by

-th component is given by

.

.

The cov_pca function handles missing data, coded as nan.

cov_fa (factor-analysis-based)¶

The cov_fa function fits the same factor model to the market returns. But instead of using principal component analyisis to decompose the variance, this factor analysis function uses the EM (expectation-maximization) algorithm to iteratively find a maximum-likelihood fit.

For background on the factor analysis model and its EM solution see Andrew Ng’s freely available machine-leaning notes.

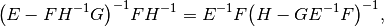

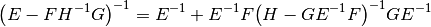

The only difference between our algorithm and his is that we use the matrix identities

and

to reduce  matrix inversions to

matrix inversions to  matrix

inversions. These identities result form standard blockwise inversion

teckniques, for instance on wikipedia

here.

matrix

inversions. These identities result form standard blockwise inversion

teckniques, for instance on wikipedia

here.

We apply them with  ,

,  ,

,  , and

, and

during the E-step in order to avoid

during the E-step in order to avoid  inversions.

inversions.

The cov_fa function cannot handle missing data.